Book Consultation

The tax compliance world in India has changed significantly due to the mandatory requirements introduced under Section 43B(h) MSME Compliance of the Income Tax Act, 1961, as amended from time to time. Effective from 1st April 2024 (AY 2024-25), this regulation has created a major shift in how businesses must handle payments to Micro and Small Enterprises registered under the MSMED Act.

This guide has been designed to help Business Owners, Accountants, CFOs and Compliance Officers understand what Section 43B(h) entails, why timely MSME payments are now critical, and how to implement full compliance in a practical and user-friendly manner.

The purpose of Section 43B(h) of the Income Tax Act 1961 has been to create the following positive outcomes for businesses based in India:

Under the provisions of this section, any expense claimed by a business for tax deduction cannot be allowed if any payment(s) made by that business to MSMEs occur later than the specified time limits of 15 days or 45 days from the date specified in either a written or oral agreement. Importantly, if you have been able to deduct a particular expense for tax purposes because you have made a payment on the day you incurred it, the only way you can deduct it subsequently is if you... have made a payment within the time specified for your deduction.

Section 43B(h) only applies to those suppliers whose registration as Micro or Small enterprises was through Udyam Registration.

MSME Classification According to the MSMED Act 2006

| Classification of Enterprise | Investment Threshold | Annual Turnover Threshold |

| Micro Enterprises | ≤ ₹1 Crore | ≤ ₹5 Crore |

| Small Enterprises | ≤ ₹10 Crore | ≤ ₹50 Crore |

🔹 Medium Enterprises are not included under Section 43B(h).

🔹 Retailers and wholesale suppliers will also not qualify to claim the benefits under Section 43B(h), even if they hold a Udyam Registration.

Section 43B (h) relies on the definition of legally permitted times for payment as set forth in Section 15 (MSMED Act 2006).

a. The Payment Terms of an Agreement (maximum 45 days) Buyers and suppliers agree to mutually-set payment terms of the agreement cannot be longer than forty-five (45) days.

Consequently, neither MSME contracts may require payments within sixty (60) or ninety (90) days of acceptance/delivery.

b. If no written agreement is present, the payment should occur no later than fifteen days from the date of the acceptance, or delivery of the items/services.

What is the Day of Acceptance?

The day on which the items or services were delivered. If the buyer has any issues or concerns regarding the Delivery and they raise the matter in writing within fifteen days of acceptance/delivery, the date when the buyer resolves their issue or concern is considered "the day of acceptance".

Expenses (i.e. A deductible expense) : Where payments made within the 15 to 45 days of the due date (including any portion before the due date), the financial year of the payments shall be deemed to be the year of the deduction.

Non-Expenses (i.e. Not a deductible expense): Where payments made after the 15 to 45 days of the due date, the financial year of the payments shall be deemed to be the year of the payment. You cannot utilize payments prior to the filing of your tax return as per the provisions of section 43B of the Income Tax Act.

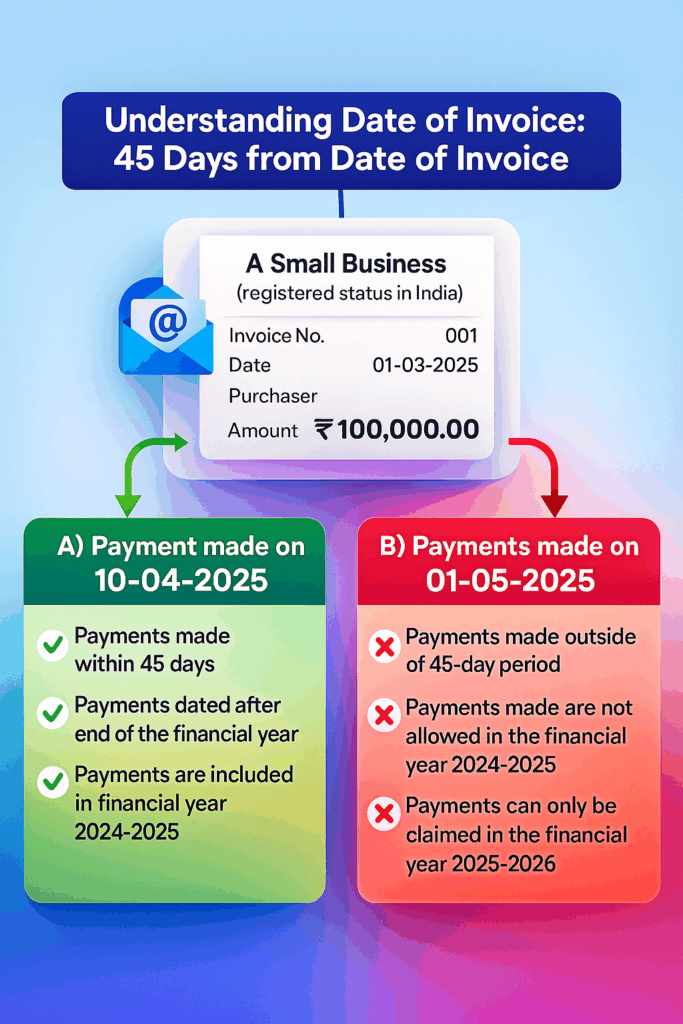

Seller Name: A Small Business (with a registered status in India)

Understanding Date of Invoice: 45 days from the date of invoice

Amount of Invoice: ₹100,000.00 (Indian Rupee)

1. Payments made within 45 days

2. Payments dated after end of the financial year

3. Payments are included in financial year 2024-2025

1. Payments made outside of 45-day period

2. Payments made are not allowed in the financial year 2024-2025

3. Payments can only be claimed in the financial year 2025-2026.

If a buyer delays payment, the law requires them to pay interest at three times the RBI Bank Rate (as on year-end), compounded monthly.

The above interest will not be tax deductible under Section 80C of Income Tax Act.

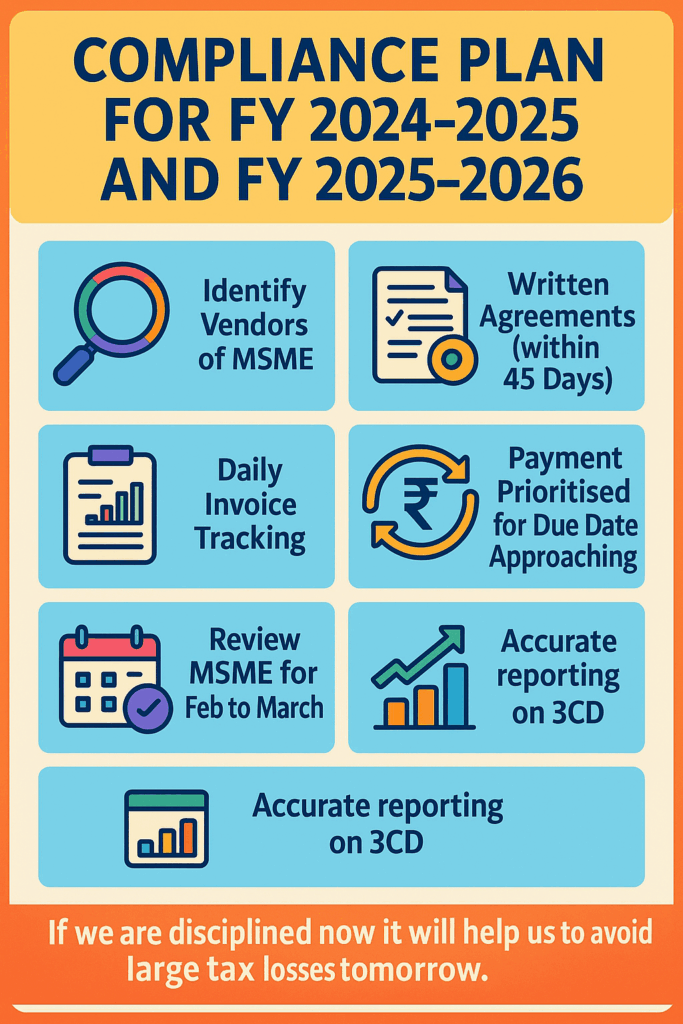

Businesses must act NOW to minimize their year-end disallowances.

It is required that businesses must disclose the following:

Managing payments under the MSMEs' Act is no longer an option; it is now required by law.

Book My Accountant (BMA) is a specialist in the area of Vendor Management and MSME compliance w.r.t. 43B(h) advisory services, as well as tax audit documentation.

Within that scope, we provide the following services:

Section 43B(h) is non-negotiable and strictly applied. You must pay within 15 or 45 days to claim the deduction; otherwise, the tax authorities will disallow the expense and add it to your taxable income. MSME interest cannot be deducted. The period from February to March could have the highest risk for business owners. Further, audit report preparation requires clean documentation.

Disclaimer

This website is intended to provide information and education (in general) to the reader and should not be regarded as advice on any issue, including legal advice, tax advice, or compliance advice. Legal requirements, notifications and tax laws may change. Readers should seek professional advice from a qualified professional for a thorough understanding of their own situation or check the latest legal amendments on the government websites.

Book My Accountant (BMA) provides professional services; however, this document's content is not intended to be a substitute for BMA's personal advisory services.

"*" indicates required fields